Top 10 Investments Every Doctor/Dentist Should be Investing On: Just as investment is important to business owners, it is also important to doctors. Apart from their monthly salaries, doctors should invest wisely to make more income .

Doctors can make additional income by investing in various investment opportunities. Your investment now as a doctor can be of immense benefit during your retirement years. Your investment can secure your financial future even when your monthly salary stops coming in.

There are various types of investments and they can help you achieve your financial goals. Each type of investment has its own general set of features, risk factors and benefits to investors.

Below are 10 different types of investments that every doctor should invest in.

Bonds

This is a loan an investor makes to a corporation, government, federal agency or any other organization in exchange for payments of interest over a specified period of time including the repayment of the principal loan at the bond’s maturity date.

Bonds

There are a wide variety of bonds such as treasuries, agency bonds, individual bonds, corporate bonds, municipal bonds and more.

When you invest in bonds, you face the possible risk of losing money, especially if you bought an individual bond and you want to sell it before it matures. Risk varies depending on the type of bond you invested in.

Stocks

Stocks represent ownership shares of a company or organization. When you invest in a stock, you become a part-owner of the company. Whether you make or lose money on your stock investment depends on the success or failure of the company, the specific type of stock you own, the performance of the stock in the stock market, and other certain factors. You need to know more about the company you want to buy stocks from before buying so that you don’t run into losses.

Stocks

There are two main types of stock which are common and preferred stock. All publicly-traded companies issue common stock while some companies issue preferred stock. Preferred stock has a lower risk of losing money but also provides less potential for profits.

If you bought common stock from a company, you’re a shareholder in the company’s success or failure. When the price of the company’s shares increases, you will make profits but when it falls, you will run to a loss.

You need to keep in mind that share prices rise and fall all the time, sometimes by just a few cents and sometimes by several dollars. Shares could gain value and double or triple over time. Shares can also lose value overtime. The rise and fall of a company’s shares usually reflect investors’ demand, the success of the company and the state of the stock markets.

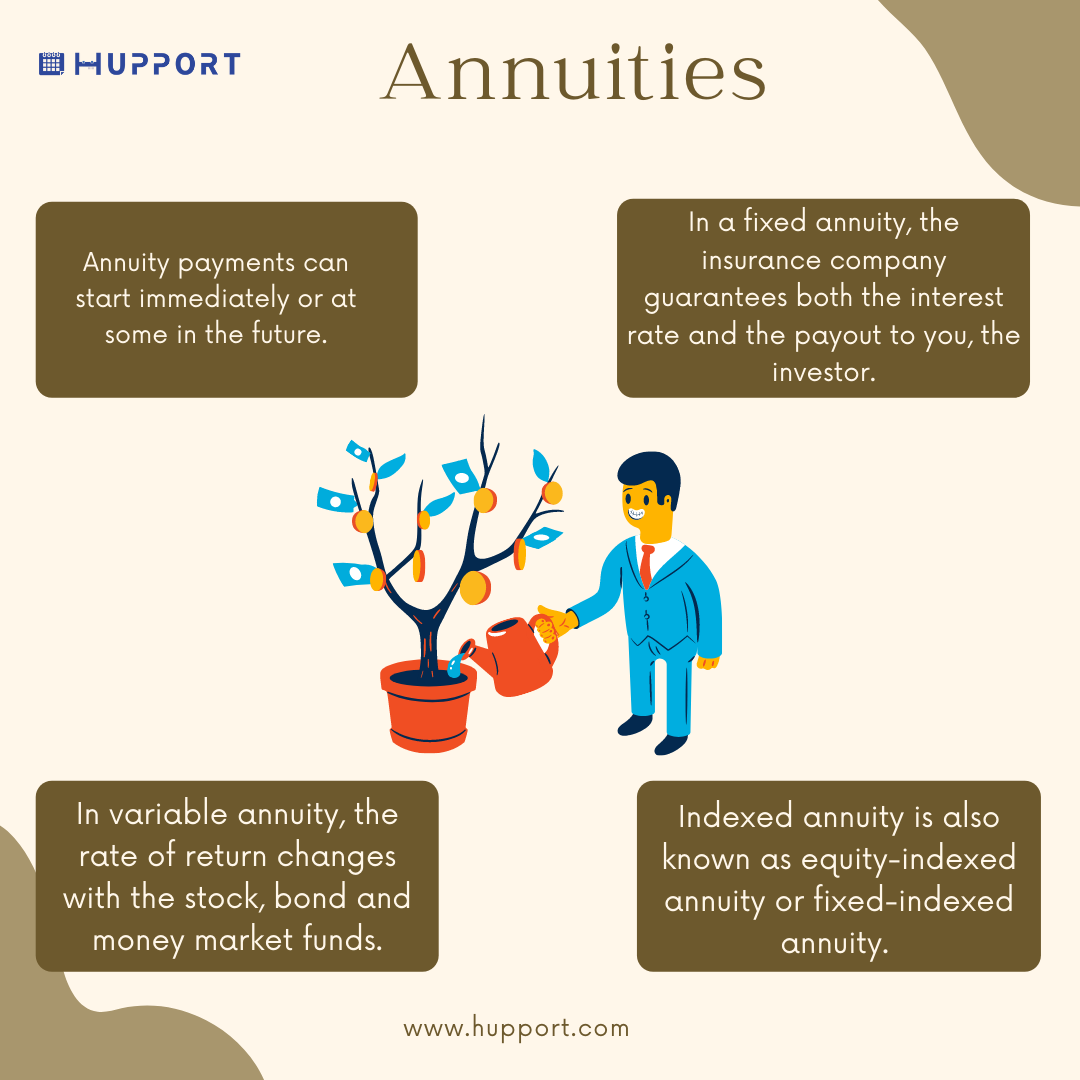

Annuities

Annuities

A contract between you and an insurance company in which the insurance company promises to make periodic payments to you is known as annuity. Annuity payments can start immediately or at some in the future.

There are three different types of annuities which are fixed, variable and indexed annuity.

In a fixed annuity, the insurance company guarantees both the interest rate and the payout to you, the investor. The interest rate is often fixed for a number of years and then changes periodically. How and when this will happen will be explained in the contract.

In variable annuity, the rate of return changes with the stock, bond and money market funds. Variable annuities do not guarantee that you will earn a return on your investment. There is the risk of losing your money.

Indexed annuity is also known as equity-indexed annuity or fixed-indexed annuity. They are complex financial investments that possess the characteristics of both fixed and variable annuities. Indexed annuities offer a minimum guaranteed interest rate including an interest rate linked to a market index.

While some annuities provide a way to save for retirement, others can help turn your savings into a stream of income during retirement.

Cryptocurrencies and Initial Coin Offerings

Cryptocurrencies and Initial Coin Offerings

Digital assets like cryptocurrencies and Initial Coin Offerings (ICOs) have continued to evolve over the years. There has been increased interest in cryptocurrencies from investors in recent times. With over a thousand different cryptocurrencies currently available, it is a market that doctors may want to invest in. You need to know that there are risks involved; hence you should consult a professional financial manager for advice.

High-Yield Savings Account

High-Yield Savings Account

Saving your money in high-yielding saving accounts is another way you can invest your money. When you save your money in these types of accounts, they accrue interest over time. Saving your money in a fixed deposit account can also accrue interests over time.

Real estate

Real estate

Investing in real estate is one of the best investments available. You could make huge amounts of money by investing in real estate. Real estate investments can be a really great addition to your investments and can provide good returns in the future.

Buying landed properties and selling them at a later time when the value of the properties increase can earn you thousands of dollars as profits.

Real estate syndications and funds

Real estate syndications and funds

If you don’t want to buy properties outright or you don’t have the luxury of time to buy yourself, you can invest in real estate syndications and funds.

Real estate syndications and funds basically refer to giving your money to a sponsor or someone who also collects money from other people to buy one large property or many properties. You go into an agreement with the sponsor and make money according to the terms of your agreement. You usually make money if the investment is profitable and may also lose money if the investment is not profitable. Performing thorough research and due diligence are important before investing if you don’t want to lose your money.

Investing in private practice

Investing in private practice

As a doctor, investing in your practice is one of the best investments you can make. Investing in private hospital or clinic can generate huge returns in the future. You could invest in a private practice and become very wealthy in the future. However, extensive research, due diligence and dedication to growing your private practice are required so you don’t go at a loss.

Investing in gold and diamonds

Investing in gold and diamonds

As a doctor, you can make huge returns by investing in gold and diamonds. Buying jewelry made of gold or diamond and keeping them for a period of time before selling them when their value increases can earn you good returns. You can also buy wristwatches made of gold and keep them for a period of time before reselling. This is an easy investment that can earn you good returns in the future.

Investing in yourself

Investing in yourself

As a doctor, investing in yourself is a good investment that can yield good returns in the future. You can invest in yourself by going for professional certifications.

Invest in your well-being, your personal and professional life. You can also invest in your financial education. Investing in yourself is one of the greatest investments you can ever make.